Increase Net Income and Eliminate Employee Benefit Expenses

Our established employee benefit prefunding investment program can significantly boost your net income while eliminating employee benefit expenses, empowering you to offer the "Free" benefits necessary to attract and retain employees.

Our unique plan leverages investments that yield 4-5x your current earnings, funding a comprehensive employee benefits program:

- Fully covered employee benefits

- Increased 401K match

- Employee pensions

- Plus a CEO retirement package 3x the average rate.

NCUA Regulation 701.19 Allows Your Credit Union To Fully Fund Your Employee Benefits Plan With Investment Proceeds.

- NCUA regulation 701.19 empowers credit unions to compete for top talent.

- Investment Flexibility: Permits normally non-permissible investments used to recruit, reward, retain, and retire key employees.

- Diverse Investment Options: Includes stocks, bonds, mutual funds, ETFs, life insurance, annuities, and more.

- Eliminate the burden of rising benefit costs, estimated at 4% - 8% per year.

See the Results for Yourself

Our program has gone through 30+ NCUA audits across various credit union partners and passed with flying colors.

Case Study 1

Asset size: $137 million

Challenges:

• Wanted to reward and retain executive team but didn't have the budget.

• Had a 401(K) but no match and poor participation.

• Being in a rural area, they were having trouble finding staff.

• Wanted to reward and retain executive team but didn't have the budget.

• Had a 401(K) but no match and poor participation.

• Being in a rural area, they were having trouble finding staff.

Plan:

Invest $1.25 million a quarter for five years.

Result:

In 2020, when the market was down over 25%, the credit union had zero losses and was able to earn over 17% in the following market recovery. Credit Union was able to have all their employee benefits cost paid for by year four and implement an executive retention package.

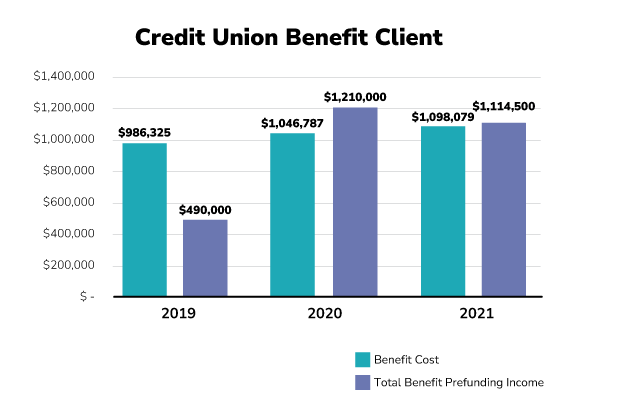

Case Study 2

Asset size: $347 million

Challenges:

• Wanted to build a retention package for their new CEO.

• Costly renewal rates on their health insurance premium had shifted more of the financial burden to their employees.

• Wanted to build a retention package for their new CEO.

• Costly renewal rates on their health insurance premium had shifted more of the financial burden to their employees.

Plan:

Invest $5 million year for seven years.

Result:

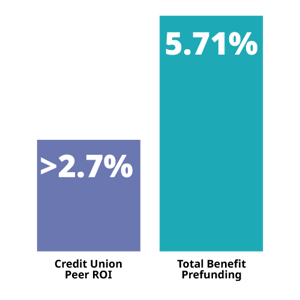

Currently they are in year four and are on track to be able to pay 100% of health premiums for their employees by year seven. They had zero market losses during Covid and in 2022, which allowed them the ability to continue to build for the future. While the credit union's peer group average ROI is under 2.7%, their ROI on Total Benefit Prefunding has been 5.71%.

Beyond Employee Health Benefits

701.19 investment proceeds can cover these costs too!

Employee Spot Bonuses

Long Term Care

Life Insurance

Generous CEO Benefits Package

Health Insurance (Health, Vision, Dental)

401K (Match and Plan Costs)

Pensions

Board of Directors Training and Meeting Costs

Employee Travel, Boarding, Training/Conference Fees

Employee Holiday Pay

Vacation, Sick, PTO Days

Employee Team Incentives

Excerpts from recent Callahan & Associates webinar “Never Pay for Employee Benefits Again” with David Sims of CU Benefit.

1

“Combating Rise in Employee Benefit Costs” (3:34)

2

“Building an Endowment to Prefund Employee Benefit Costs into Perpetuity” (1:51)

3

“Creating a Customized Investment Plan” (2:17)

4

“COLI/BOLI Doesn’t Cut the Mustard” (2:24)

How Credit Union Benefit is Compensated.

There is no cost for CUB consulting, designing or implementing your plan. Depending on the strategy chosen by credit union leadership, CUB is compensated in one of two ways:

- Insurance company or investment provider pays CUB a commission at no cost to the credit union. (90% of the time)

- If the solution is fee-based, CUB charges a percentage of the plan. (10% of the time)

CUB is truly unbiased when it comes to its investment recommendations, as we are the credit union's advocate to find the most competitive and innovative way to achieve your employee benefit pre-funding goals.

"I appreciate Credit Union Benefit’s ability to think outside the box and craft a plan that benefits not only our employees, but the credit union as a whole. We have been using CU Benefit since 2020 and with their assistance we have made it through two NCUA audit exams to date."

Steve AdeePresident/CEO